行動讓你前進,思考決定方向。

先謀定而後動,目標才能達到。

2015年12月29日 星期二

2015年12月4日 星期五

肉眼所見事物,未能反應真實 。

肉眼可見星星的等級,可分為一等星到六等星。

其中最亮的一等星,比六等星的亮度高上100倍,

但其實可能部份六等星只是因為距離地球比較遠,

所以亮度無法完全傳達到地球上。

肉眼所見事物,未能反應真實 。

from 怪醫黑傑克.

其中最亮的一等星,比六等星的亮度高上100倍,

但其實可能部份六等星只是因為距離地球比較遠,

所以亮度無法完全傳達到地球上。

肉眼所見事物,未能反應真實 。

from 怪醫黑傑克.

標籤:

用心去感受

2015年11月30日 星期一

2015年11月21日 星期六

2015年11月12日 星期四

2015年11月5日 星期四

2015年11月4日 星期三

2015年11月3日 星期二

(Discovery Channel) 二次大戰全彩實錄

去了趟歐洲,突然很想瞭解二戰的時空背景,

後來發現Discovery有出這一系列的影片,

名稱叫做:"(Discovery Channel) 二次大戰全彩實錄"

以下是其中一部,推一下囉~

標籤:

二次大戰

2015年11月2日 星期一

2015年10月30日 星期五

Someone strange, something happened. Time will tell, till that day.

當你還在深信不疑,事情已經悄然發生。

時間將會證明一切,直到謎底揭曉那天。

Someone strange, something happened.

Time will tell, till that day.

By Sivitry.

標籤:

用心去感受

2015年10月27日 星期二

2015年10月26日 星期一

再回首,對與錯早已不再重要

再回首,對與錯早已不再重要

By Sivitry.

同名小說:

http://baike.baidu.com/view/11912158.htm

人生一世,总会遇到诸多不尽如人意的事情,其实世上没有永远的幸福,也没有永远的遗憾,遗憾在所难免,幸福也是触手可及,永远也不过刹那瞬间,当浮华落尽,容颜老去,那时才会发现,人生最需要的是平和的心情。 只要曾经拥有,何必天长地久,当看透了一切时,相爱不会相守又算的了什么呢?

標籤:

用心去感受

2015年10月20日 星期二

Life is easy. Why do we make it so hard?

Life is easy. Why do we make it so hard? | Jon Jandai | TEDxDoiSuthep

這世界的生活繁雜且困難,

生活的如此辛苦是為了什麼?

是貸款30年買一間房?

還是花一個月的薪水買一隻智慧手機?

對於某一個東西,喜歡不代表一定要,需要表示真的會用到,

買東西之前請問自己是喜歡還是需要。

生活可以很簡單。Life is easy.

https://www.youtube.com/watch?v=21j_OCNLuYg

標籤:

用心去感受

2015年10月18日 星期日

iPhone 備份照片 匯入圖片及視訊

一般備份iPhone照片的方式都是將iPhone連接到電腦,

然後像使用USB一樣選取要照片,複製到C槽或D槽貼上。

但是!!

先前依這樣做,原本選取幾百或幾千個照片要複製的時候,

複製到20個照片左右,就會停住沒有回應。

因此...上網找了好久,才發現另外一種方式可以將iPhone的照片取出~

解法:

> 到檔案總管

> 右鍵選取iPhone

> 匯入圖片及視訊

只要三步驟就可以完整複製iPhone內所有照片和影片~

需要看圖片說明可到以下的網址

原網址

終於不用20個20個這樣複製了...

Yabi!

標籤:

iphone

Yesterday is gone. Tomorrow has not yet come. We have only today. Let us begin.

Yesterday is gone. Tomorrow has not yet come. We have only today. Let us begin.

昨日已逝,明日未至,

我們只擁有今天,讓我們開始吧!

from Mother Teresa.

標籤:

用心去感受

When the Lord closes a door, somewhere He opens a window.

When the Lord closes a door, somewhere He opens a window.

當上帝關起一扇門,必會開啟另一扇窗。

from The sound of music.

標籤:

用心去感受

2015年10月2日 星期五

將 iPhone、iPad 或 iPod touch 賣掉或送人以前的注意事項

查看iphone保固

https://selfsolve.apple.com/agreementWarrantyDynamic.do

將 iPhone、iPad 或 iPod touch 賣掉或送人以前的注意事項

https://support.apple.com/zh-tw/HT201351

[iOS教學]準備賣掉舊iPhone? 教你 5 個必做準備步驟

標籤:

iphone

2015年10月1日 星期四

只有用心才看得清楚。任何重要的東西都是眼睛看不見的。

Any thing essential is invisible to the eyes.

只有用心才看得清楚。

任何重要的東西都是眼睛看不見的。

By Sivitry.

標籤:

用心去感受

2015年9月14日 星期一

2015年8月16日 星期日

寫作的力量

寫作的力量

思想活在每個人的腦海中,

溝通是面對面的傳達思想,

寫作是透過文字呈現思想。

在溝通或寫作之前,都必需整理好腦海中的思緒,

以有層次和起承轉合的方式清楚陳述,

每一次寫作,都是思想與思想的對話,

寫作的人負責把腦海的思想以文字呈現,

閱讀的人負責把文字轉化成屬於他所理解的思想,

這當中存在著兩次的轉換,很容易產生誤解和其他想像,

不過這也就是文字的魅力,

就像閱讀小說一樣,

每個人心中所想同一本小說的場景都有所不同,

如何運用文字這個工具,順利讓思想進行對話,是門深奧的學問。

總是要夜深人靜或獨處的時候,才能順利的將腦海中感性的一面以文字呈現,

文字可以將思想赤裸裸的呈現,也可以替他穿上漂亮的外衣,

端看寫作人的文筆,

寫著寫著又想起在念書時的某一天深夜,

隨手寫了些文字,而那些文字剛好傳達給了你...

by Sivitry.

2015年8月8日 星期六

CityOffice: What if your space was as dynamic as you are?

CityOffice: What if your space was as dynamic as you are?

未來的辦空室型態~

看似很有趣~ :)

未來的辦空室型態~

看似很有趣~ :)

標籤:

CityOffice

,

CPS

2015年8月3日 星期一

2015年7月29日 星期三

2015年7月27日 星期一

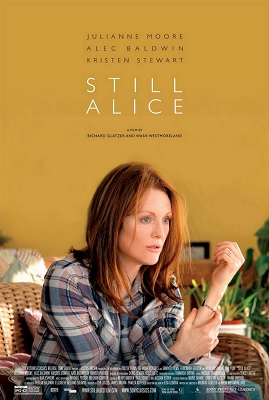

「阿茲海默症是逐漸喪失內在的記憶,而肌肉萎縮症則是逐漸喪失外在肉體的控制」

患者同樣都要面對逐漸喪失個人自主權的痛苦

http://www.catchplay.com/Movies/stillalice

2015年7月14日 星期二

Intel 530 SSD 120G,入手1988!

自從家裡的筆電換了SSD之後,一直想要把公司的筆電也換一下,

但是SSD價錢一直超過2000,

就在前幾天終於等到折價券!

滿2000,現折300,

原價2288,折完變成1988,實在是太開心啦~~~

來去安裝Windows和Office~

2015年7月2日 星期四

2015年6月29日 星期一

2015年6月12日 星期五

2015年6月10日 星期三

機車 強制險 富邦 折扣

算一算從小銀1999年出生到現在已經超過15個年頭,

時間過的好快好快~

今天才突然發現原來

小銀是巨蟹座~ (7月)

小藍是雙魚座~ (3月)

和水象星座也太有緣了吧!!

好,以上都不是重點,

今天是要說強制險的故事,

------------------------------------

以下是富邦保險的網站,線上保2年期的機車強制險可以現折150,

https://www.fubon.com/insurance/home/index.htm

也就是原價1200,折完只要繳1050,

可以選擇信用卡或線上金融帳戶繳款。

信用卡大家都知道,幾個數字輸入就可以了,

線上金融帳戶繳款這個比較特別,之前沒用過,限定要本人帳戶,然後到

富邦e化繳費網(如下)

https://ebank.taipeifubon.com.tw/ebill/servlet/HttpDispatcher/EBill_FBInsure/prompt

選擇銀行別,輸入帳號,就可以轉帳了!!!

不用提款卡也不用輸入線上密碼,還蠻方便的~

講完了,以後會繼續用這方法繳費,方便又簡單,也不用擔心信用卡資訊外漏 !

2015年5月30日 星期六

Startup 新創公司是啥

http://oresundstartups.com/definition-of-startup/

Update: a newer and more detailed version of how funding works and startups is available here – How does funding work in Nordic startups.

WHAT IS A STARTUP

Note: This text is no objective truth, but should be regarded as a highly personal opinion from me, Karsten, the initiator of this site. There is no universal accepted definition of what a startup is, and this definition below is highly influenced by people like entrepreneurs Daniel Marklund and Anton Johansson, and business angels such as Göran Tollstam. And atleast 20+ others, that I have had lengthy conversations on this theme with.

Update: a newer and more detailed version of how funding works and startups is available here – How does funding work in Nordic startups.

STARTUP = GROWTH

The best short definition of what a startup is, is Paul Grahams’s startup = growth. However, a longer answer, and an answer that is useful for people new to the world of building companies, is somewhat harder and more complex.

“A STARTUPS LIVESPAN”

A startups livespan, or the startup path, is a way that is a defacto thruth in the tech-startup world. Here in Scandinavia we have, unfortunatly, a lack of knowledge regarding what a startups livespan looks like, and what steps it includes. This leads to a lot of bad and unneccesery investments and conflicts. Something I hape to help minimize with this text.

THE SILICON VALLEY WAY

For those following the Silicon Valley model for startups, a startup can be divided into two categories:

- Bootstrapped

- Funded

A bootstrapped startups is a startups where the founders themselves, or the early costumers, fund the company and growth of the company. This is a company that uses it’s revenue to acquire further costumers, and thus grows. This is also referred to as growing organically sometimes.

A funded startup is a company where one or more investors put money into the company, and thus enable the company to develop it’s services or to acquire costumers, without the need to be cash-flow positive. The company has received the funding in order to grow quicker or to develop a new technology that takes time before it can earn money on a larger scale.

The funding process itself, can be divided into 3 different steps:

- Pre-seed

- Seed

- Series A

- Series B

- Series C

- Further series

And the “goal” of a startup is one of these three:

- IPO

- Being acquired

- Private Equity

PRE-SEED INVESTMENTS

Pre-seed is usually the very early stage investment, often done by either a business angel, or what is known as the FFF – friends, families and fools. However, for Swedish and Danish startups, this is not really the case. Unlike the U.S., an entrepreneur in Scandinavia relatively seldom has friends or family that has the € 15 000 – € 100 000 needed to get a startup going, because few people here are rich enough in that sense. However, in Scandinavia public grants often replace the FFF stage – be it Swedish Tillväxtverket or Danish Fonden for Entreprenørskab. These can often give grants in the required ranges – if your startup is working on a tech solution which is “hot” and fits into any of the numerous grant schemes.

Pre-seed is usually in the € 15 000 to € 100 000 range, and usually for 0 – 10% of the equity / shares in the company. The valuation is often around $ 1 000 000 (€ 700 000) if done correctly. A much lower valuation can cause serious problems later and actually be the bane of the startup in the long run.

Pre-seed is usually in the € 15 000 to € 100 000 range, and usually for 0 – 10% of the equity / shares in the company. The valuation is often around $ 1 000 000 (€ 700 000) if done correctly. A much lower valuation can cause serious problems later and actually be the bane of the startup in the long run.

SEED INVESTMENTS

The seed investment is the next stage. Seed investments are usually by business angels, or business angel syndicated (multiple business angels investing together), or by early seed stage VC funds.

At this point there is one very important detail: you need to have the right valuation of your startup, otherwise it will have a hard time to raise money in the next round!

Making a valuation of a company is always hard, and it is even harder for a young startup. For that reason, those business angels and VCs that know what they are doing will actually not do any fancy calculations on your valuaion. Rather, it is kept as simple as possible: a startup at an early stage for a seed investments, is deemed to be valued at $ 2 – 4 000 000. Often a rule of thumb is that if it is your first real startup, then the valuation is $ 2 000 000, while if the the second or later the valuation can be $ 3 000 000 or $ 4 000 000. Either that, or $ 0. This way, there is no need to argue over the exact valuation, and the amount of time wasted on negatiatons is reduced a lot. It also makes it rather simple to get a grip on how much equity the investor(s) should have – it totally depends on how much money you need to reach the next funding.

That the valuations are in U.S. dollars is because that is the standard internationally.

Seed investments are usually between 5 – 25 % of the shares, and usually € 50 000 – € 1 000 000.

At this point there is one very important detail: you need to have the right valuation of your startup, otherwise it will have a hard time to raise money in the next round!

Making a valuation of a company is always hard, and it is even harder for a young startup. For that reason, those business angels and VCs that know what they are doing will actually not do any fancy calculations on your valuaion. Rather, it is kept as simple as possible: a startup at an early stage for a seed investments, is deemed to be valued at $ 2 – 4 000 000. Often a rule of thumb is that if it is your first real startup, then the valuation is $ 2 000 000, while if the the second or later the valuation can be $ 3 000 000 or $ 4 000 000. Either that, or $ 0. This way, there is no need to argue over the exact valuation, and the amount of time wasted on negatiatons is reduced a lot. It also makes it rather simple to get a grip on how much equity the investor(s) should have – it totally depends on how much money you need to reach the next funding.

That the valuations are in U.S. dollars is because that is the standard internationally.

Seed investments are usually between 5 – 25 % of the shares, and usually € 50 000 – € 1 000 000.

SERIES A INVESTMENT

A series A investment is the first investment most VCs will do. VCs are often limited in what the smallest amount they can invest in a company is, and that is often in the € 100 000 – € 200 000 range. Less then that they simply cannot invest without stretching their resources too thin.

As with the Seed round, a series A round also has somewhat of a fixed valuation. Usually it is between $ 4 000 000 and $ 15 000 000. This makes it relatively easy in negotiations as well. And this also makes it so important that earlier investments are done “right” – if a startup would have done a seed round where it would give away, say 40% of it’s shares for € 100 000 – a deal that for a first-time entrepreneur can seem like a lot of money even if it is a way to low valuation, then it will be very hard, if not outright impossible, for the startup to get to a further round of funding. Which might very well spell the doom for the startup.

Also for many VCs it is very important that the founders still retain 50% of the ownership in the company even after the Series A. It is important for everyone that there is a hard focus on making a successfull company, as it requires a lot of hard work. To little ownership often makes the founders not committed in the long run, which is bad for VCs as it is their money that is being invested.

Series A investment is usually around € 500 000 – € 5 00 000 for 15 – 20 % of the shares.

As with the Seed round, a series A round also has somewhat of a fixed valuation. Usually it is between $ 4 000 000 and $ 15 000 000. This makes it relatively easy in negotiations as well. And this also makes it so important that earlier investments are done “right” – if a startup would have done a seed round where it would give away, say 40% of it’s shares for € 100 000 – a deal that for a first-time entrepreneur can seem like a lot of money even if it is a way to low valuation, then it will be very hard, if not outright impossible, for the startup to get to a further round of funding. Which might very well spell the doom for the startup.

Also for many VCs it is very important that the founders still retain 50% of the ownership in the company even after the Series A. It is important for everyone that there is a hard focus on making a successfull company, as it requires a lot of hard work. To little ownership often makes the founders not committed in the long run, which is bad for VCs as it is their money that is being invested.

Series A investment is usually around € 500 000 – € 5 00 000 for 15 – 20 % of the shares.

SERIES B INVESTMENTS AND FURTHER

After series A it gets more complicated. Now there suddenly is no fixed measurements anymore, and by now the startups has dozens of employees and hopefully a fast growing costumer or user-base. Series B and onwards, with series C being relatively common but series D or E quiet rare, the entrepreneurs themselves are not that active in the deals and the valuations. Once you are here, you will have enough knowledge and know-how around you, to take you further on the startups path.

“THE END”: IPO OR ACQUISITION

If you take funding, then the investors wants a return on the investment sooner or later. This often comes either thru the startup being acquired by a bigger corporation, or by being listed on a public stock exchange, in an IPO – initial public offering. Some frown down upon acquisitions, saying that only IPO, or even better, private equity, is the only real way to build a world-changing company. However, that is a luxury few entrepreneurs can achieve, and an acquisition might do wonders for the entrepreneurs and investors, who get money to build or fund new startups.

BOOTSTRAPPED VS FUNDING

The above is true if you have received funding. However, there are entrepreneurs who view funding as something negative and to be avoided. Especially in Scandinavia. And as we can see above, a round of funding done the wrong way, can actually be the end of your startup. And it already has meant the end for many startups. Therefor it is not without reason that there is a mentality of scepticism against funding amongst some entrepreneurs.

This is by no means wrong. However, if a startup wants to continue to grow, it quite almost always takes some investment sooner or later – even if the founders are against VCs and funding in the beginning, the pure fact that the right investor can help any startup grow dramatically, often means that they change their minds a couple of years in.

However bootstrapped companies that receive funding later can often “skip” one or two steps in the investments path – a startup that has grown organically often has no need for a pre-seed, and maybe not even for a seed round. And if it has done really well, maybe not even a series A round.

Thus, the main difference between bootstrapped and funded startups is often only the first couple of years – in the long run, they follow the same path and the same funding challenges. That is if the ambition is to grow big.

標籤:

technology

2015年5月27日 星期三

2015年5月5日 星期二

2015年5月1日 星期五

對敵人仁慈就是對自己殘忍,對自己仁慈也是對自己殘忍。

對敵人仁慈就是對自己殘忍,對自己仁慈也是對自己殘忍。

不是說不需要善待自己,

而是給自己訂下短中長期的目標並嚴格執行,

最後才能順利完成原本設立的目標,

在過程中要注意莫望初衷,免得走偏了XD。

盤點了一下先前設定的目標,現在達成的有:

日文二級 (約兩年)

職場升級 (約兩年)

對自己太仁慈的有:

程式相關證照 J2EE、LPIC (買了書沒去考,對自己太仁慈的後果就是浪費了一堆錢...)

賣房子XD (三年前的想法,一樣是太仁慈的後果...)

八十俱樂部 (站在秤子上都不好意思看指針了。) OS: 這是放縱吧!

2015年4月30日 星期四

中醫四診「望聞問切」

中醫四診「望聞問切」,難經云:

「望而知之謂之神,聞而知之謂之聖,問而知之謂之工,切而知之謂之巧」。

[1望診]

的主要內容是觀察人體的神色形態,醫生運用視覺從病患之臉色、眼色、精神氣色及外貌形觀看出端倪。一般來說,健康人的神、色、形、態,都有其正常的表現,一旦有反常,便是變態。從中醫臨床經驗可得知,人體外部跟五臟六腑有著密不可分的聯繫存在,尤其是面部、舌部跟臟腑的關係更為密切,因此醫生透過對患者外部的觀察,可以了解臟腑的病變,進而找出疾病的本質以增進治療效益。

望診的內容雖然可以區分為總體望診跟局部望診,但在運用之時,並不需要特別去區分,在此我們將討論到的項目有:望神、望色、望形態、舌診、望顏面、望頸項、望頭髮、望皮膚、望苗竅、望指紋、望二陰、望排出物。

望診的內容雖然可以區分為總體望診跟局部望診,但在運用之時,並不需要特別去區分,在此我們將討論到的項目有:望神、望色、望形態、舌診、望顏面、望頸項、望頭髮、望皮膚、望苗竅、望指紋、望二陰、望排出物。

[2聞診]

包括聽聲音、聞氣味兩方面。其中聲音包含了說話聲、腳步聲、動作聲、呼吸聲以及咳嗽聲等各類聲音。藉由判斷所聽到聲音的強弱及頻率是否正常來作為辨證的依據。而氣味則包括了口氣、汗氣、體臭、鼻氣及排出物氣味等。藉由氣味的濃厚來反映出病者身體的寒熱虛實狀況。

聞診的基本原理在於聲音和氣味都是由臟腑生理和病理活動中所產生的,所以能反映出臟腑的生理和病理變化。

[4切診]

聞診的基本原理在於聲音和氣味都是由臟腑生理和病理活動中所產生的,所以能反映出臟腑的生理和病理變化。

[3問診]

即向病人或其家屬有步驟、有目的地詢問病史。問診是詢問病人疾病的發生與經過,問清病人的主要痛苦與症狀,了解病人的體質、生活習慣等有關內容,以達到掌握重點,結合其他三診來診察疾病的目的,並為辨證蒐集有關的資料。

問診重點著重在現在症狀。現在症狀以十問歌為要點:一問寒熱二問汗,三問頭身四問便,五問飲食六胸腹,七聾八渴俱當辨,九問舊病十問因,再兼服藥參機變,婦女尤必問經期,遲速閉崩皆可見,更添片語告兒科,麻豆經疳須佔驗。此十問可以說是現在病症治療的要點。茲將此十問區分如下:問寒熱、問汗、問頭身、問二便、問飲食與口味、問胸脅脘腹、問耳目、問渴飲、問睡眠、問婦女與小兒病

問診重點著重在現在症狀。現在症狀以十問歌為要點:一問寒熱二問汗,三問頭身四問便,五問飲食六胸腹,七聾八渴俱當辨,九問舊病十問因,再兼服藥參機變,婦女尤必問經期,遲速閉崩皆可見,更添片語告兒科,麻豆經疳須佔驗。此十問可以說是現在病症治療的要點。茲將此十問區分如下:問寒熱、問汗、問頭身、問二便、問飲食與口味、問胸脅脘腹、問耳目、問渴飲、問睡眠、問婦女與小兒病

[4切診]

的內容包括了脈診跟按診兩部分,兩者同樣是運用醫生的手,對病人體表進行觸、摸、按壓,以了解病情的一種診斷方法。脈診是按脈搏,按診是對病人的肌膚、手足、腹胸及其它部位的觸摸按壓。

藉由診脈,可以判斷疾病的病位、性質和邪正盛衰也可以推斷疾病的進退預後。常用的診脈部位有遍診法、三部診法和寸口診法三種。醫生在診斷時須注意到時間、體位、指法等診脈的方法,然後依照脈像所顯示出來的病脈判斷出其所代表的病症。

而按診可分為觸、摸、壓按三類,各種手法是綜合運用的。藉由按診可以了解局部的異常變化,從而推斷疾病的部分、性質和病情的輕重等情況。

藉由診脈,可以判斷疾病的病位、性質和邪正盛衰也可以推斷疾病的進退預後。常用的診脈部位有遍診法、三部診法和寸口診法三種。醫生在診斷時須注意到時間、體位、指法等診脈的方法,然後依照脈像所顯示出來的病脈判斷出其所代表的病症。

而按診可分為觸、摸、壓按三類,各種手法是綜合運用的。藉由按診可以了解局部的異常變化,從而推斷疾病的部分、性質和病情的輕重等情況。

from this

2015年4月27日 星期一

2015年4月25日 星期六

2015年3月6日 星期五

建設性的批評 vs 無建設性的批評

多了頭銜,多了責任,

也多了和他人溝通的頻率,

討論的時候有很多意見,我都虛心接受,

也非常歡迎任何有建設性的批評,

但無建設性的批評,只會讓人意志消沉。

希望負面情緒快快退散!

2015年1月12日 星期一

2015年1月10日 星期六

2015年1月8日 星期四

2015年1月1日 星期四

訂閱:

意見

(

Atom

)